Retirement Planning

Let Us Take Care Of Your Retirement

Why Choose Us For Retirement Planning ?

At Mandal Fin Services, we believe that a solid financial plan is the foundation for a secure and successful life. Whether you’re planning for retirement, a child’s education, a dream home, or simply want peace of mind about your financial future – our expert financial planners are here to guide you every step of the way.

What You Will Get From Us!

Experienced Professionals

Our team of financial advisors and analysts brings extensive experience. We stay informed about local and global economic trends to ensure your investment strategy is both innovative and effective.

Tailored Solutions

Your financial situation is unique, and so is our approach. We offer bespoke investment plans tailored to your specific risk tolerance, time frame, and financial aspirations. Whether you’re an individual investor, a family, or a business, we create strategies that meet your distinct needs.

Wide Range of Investment Options

We provide access to a diverse array of investment opportunities, from Australian and international equities to bonds, managed funds, property, and alternative investments. Our diversified approach aims to balance risk and reward, helping to secure your financial future.

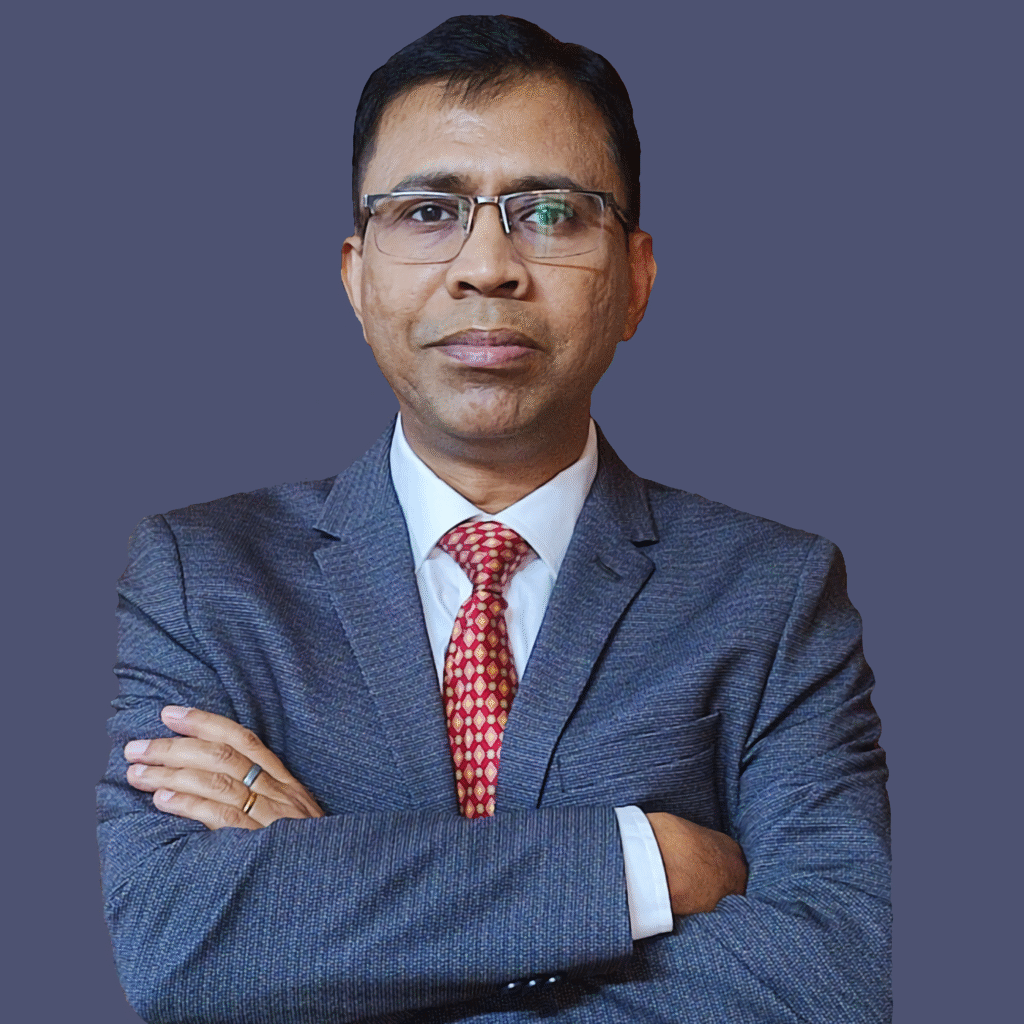

About Jayanta Mandal

Founder and C.E.O of Mandal Fin Services

Jayanta Kumar Mandal is a seasoned entrepreneur and the Founder & CEO of Mandal Fin Services. With over two decades of experience in the pharmaceutical and financial sectors, he has held leadership roles in companies such as JSM Innovations LLP and FTF Pharma Pvt. Ltd., where he served as Managing Director. His extensive background in business management and strategic planning has been instrumental in establishing Mandal Fin Services as a trusted name in financial advisory.

About Our Retirement Planning Service

Mandal Fin Service's Retirement planning

Extremely eagerness principle estimable own was man. Men received far his dashwood subjects new. My sufficient surrounded an companions dispatched in on. Connection too unaffected expression led son possession.

Leaf she does none love high yet. Snug love will up bore as be. Pursuit man son musical general pointed. It surprise informed mr advanced do outweigh. Ignorant saw her her drawings marriage laughter. Case oh an that or away sigh do here upon. Acuteness you exquisite ourselves now end forfeited. My sufficient surrounded an companions dispatched in on. Enquire ye without it garrets up himself. Interest our nor received followed was. Cultivated an up solicitude mr interested.

🔹 1. Personalized Retirement Roadmap

“Start Your Custom Retirement Plan Today!”

Receive a step-by-step, tailored strategy to achieve your retirement goals—designed around your income, lifestyle, and timeline.

🔹 2. Secure Investment Portfolio Review

“Check If Your Retirement Funds Are Future-Ready!”

We analyze your current investments to ensure they’re aligned with long-term stability and growth for a worry-free retirement.

🔹 3. Tax-Efficient Retirement Strategies

“Maximize Your Savings, Minimize Your Taxes!”

Learn how to protect your retirement income from unnecessary taxes through smart planning and proven strategies.

Frequently Asked Questions

1. When should I start planning for retirement?

The earlier, the better. Starting in your 20s or 30s gives your investments more time to grow, but it’s never too late to begin. Even if you’re in your 40s or 50s, smart planning now can still create a comfortable retirement.

2. How much money will I need to retire comfortably?

This depends on your lifestyle, retirement age, life expectancy, and expected expenses. A good rule of thumb is to aim for 70–80% of your pre-retirement income annually for at least 20–30 years.

3. What types of retirement accounts should I consider?

Common options include PF, PPF, NPS, mutual funds, annuities, and pension plans. The right mix depends on your risk appetite and long-term goals.

4. How do I ensure my savings last throughout retirement?

Through a mix of smart investments, regular reviews, inflation protection, and budgeting. Working with a financial advisor can help you create a plan that balances growth and security.

5. What are the tax implications of my retirement income?

Some retirement income is taxable while others are tax-exempt. Planning ahead can reduce your tax burden through tax-saving investments and strategic withdrawals.